Like in bermuda

US compares Switzerland to Bermuda – Former Ambassador Thomas Borr is most afraid

The new US President Joe Biden wants to find money for his populism in tax havens. Switzerland is considered the most important of these. Is history repeating itself?

Like Switzerland in Bermuda?

Joe Biden does not speak of “Make America Great Again” as did predecessor Donald Trump. But he specializes in populist terminology. He recently complained: “Damn it, I’m tired of the common people. Unlike Trump, Biden also acts like a populist. There are consequences for Switzerland.

The New York Times writes, “Biden fulfilled the promises that Trump broke.” Trump promised investment in infrastructure but never delivered. His tax reform particularly benefited the richest. Biden has come up with a popular infrastructure plan. For this, he wants more taxes from American multinationals and the rich, which is also popular.

Biden wants to find money for his populism at Tax Havens – one of the most important should be Switzerland. Thomas Borer says:

“Switzerland needs to be careful, otherwise it will be targeted again by the US administration.”

Former Swiss Ambassador recalls: Democratic presidents like Clinton and Obama were more popular in Switzerland than Republicans Bush and Trump. “But we had too much trouble under Clinton and Obama.”

Task Force led in World War II when Bill Clinton led the investigation and class action against the Swiss Financial Center. In the end, the big banks paid around 1.8 billion francs in a comparison. Barack Obama brought down banking secrecy, even though it was previously considered sacred. Federal Councilor Kaspar Wilger said one thing: “Banking secrecy is in our genes.”

Borer leads the “Switzerland-World War II” task force

Now Biden is taking a tax haven. In its “tax plan” it states: Other countries should not have a competitive advantage by becoming “tax havens”. And in which countries Biden has oshes that can be read in footnotes: Bermuda and Cayman, Ireland and Luxembourg, Netherlands and Singapore – and Switzerland. In the analysis submitted to the Senate committee, Switzerland is listed as a “low-tax country”.

Finance Minister Janet Yellen also portrayed Switzerland as a tax haven. In an article for the “Wall Street Journal”, he put Switzerland on par with Bermuda’s British overseas territory. The US would not like to compete on whether it could have lower taxes than Bermuda or Switzerland.

In Bermuda, the world of tax is out of joint

They think of such matters in Biden’s administration as can be found in the tax scheme. In “small tax havens” – including Switzerland – US multinationals will benefit more than six large countries combined: China, India, Japan, Canada, France and Germany. The tax world in Bermuda is particularly out of joint, at least from Biden’s point of view. The archipelago has only 64,000 inhabitants, but American multinationals claim in their tax documents that they made a huge profit there: about 10 percent of all profits generated abroad.

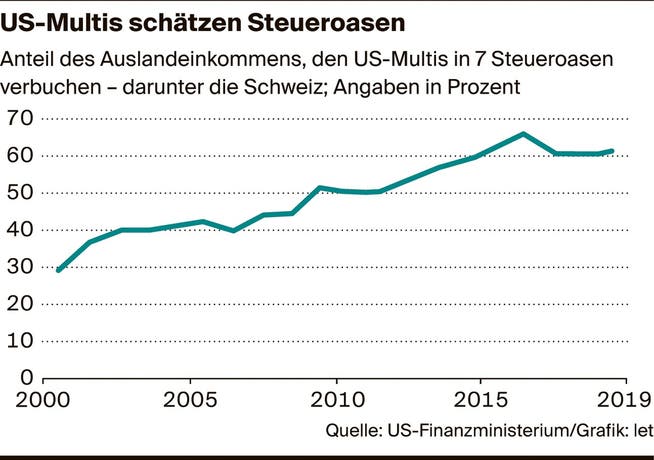

More recently, the American tax world has become even more out of hand, at least from Biden’s point of view. Tax havens are enjoying increasing popularity among American multinationals. They book 60 percent of total foreign income there – double that under President George W. Bush (see graphic).

Biden v US Multinational: This is a conflict in American domestic politics in itself. But Switzerland is drawn into it. Because Biden wants to stop multinationals from collecting taxes from home. Therefore he wants a global minimum tax rate. And this rate will be much higher than some cantonments.

“Switzerland must be ready, otherwise it will be scrapped,” ex-Ambassador Borer said. The equation with Bermuda should correct their diplomacy. A certain peace is justified. So far, all attempts have failed. The European Union also could not agree internally on the minimum tax rate. Nevertheless, it is important to have alliances with like-minded countries. «We cannot afford to just wait and watch. And we have to bring our good arguments to the Biden administration. “

With all seriousness and with high fines

Meanwhile, Biden is working on the next advance, which will result in Switzerland. The rich should pay a “fair share” of taxes. For this, Biden wants to pay more money to the hungry IRS. Among other things, it should better implement the FATCA. With the agreement, banking secrecy in Switzerland had actually ended. But according to their own assessments, Americans have so far not controlled enough enforcement.

“Americans will move forward with extreme severity and high fines,” Borer said. Nowadays, sooner or later every tax extension reaches the authorities. Therefore, it is stupid to hand over the tax avoidance strategy in any way. “A single whistleblower is enough – and everything is exposed.”

Reader. Organizer. General creator. Zombie fanatic. Alcohol advocate. Food junkie. Bacon ninja.