Not Russia or India, but fundamentally liberal Canada is now interfering in crypto trading in a big way. The Ontario Securities Commission (OSC) supersedes the Regional Securities Commission for the Province of Ontario decision madeCrypto exchanges and brokers will have to introduce their new regulations. Anyone who wants to be fully regulated as a crypto trader should implement purchase limits for crypto currencies with immediate effect. The new regulatory requirement applies to the following regions of Canada: Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, the Northwest Territories, Nunavut and Yukon.

Small investors in these regions are only allowed to invest 30,000 Canadian dollars (CAD) per year in altcoins through official trading venues. Professional investors at least 100,000 Canadian dollars. The following cryptocurrencies are excluded, which investors can continue to buy indefinitely: Bitcoin, Ethereum, Litecoin and Bitcoin Cash. So far fact,

Canada: patriarchy instead of consumer protection

The fact that the state is now specifying its own crypto portfolio strategy is a scam. Under the guise of consumer protection, investors want to protect themselves from bad investments. Not only is this an encroachment on the freedom of investors, which can be expected in a country like Canada, but it also leads to dangerous mis-allocations.

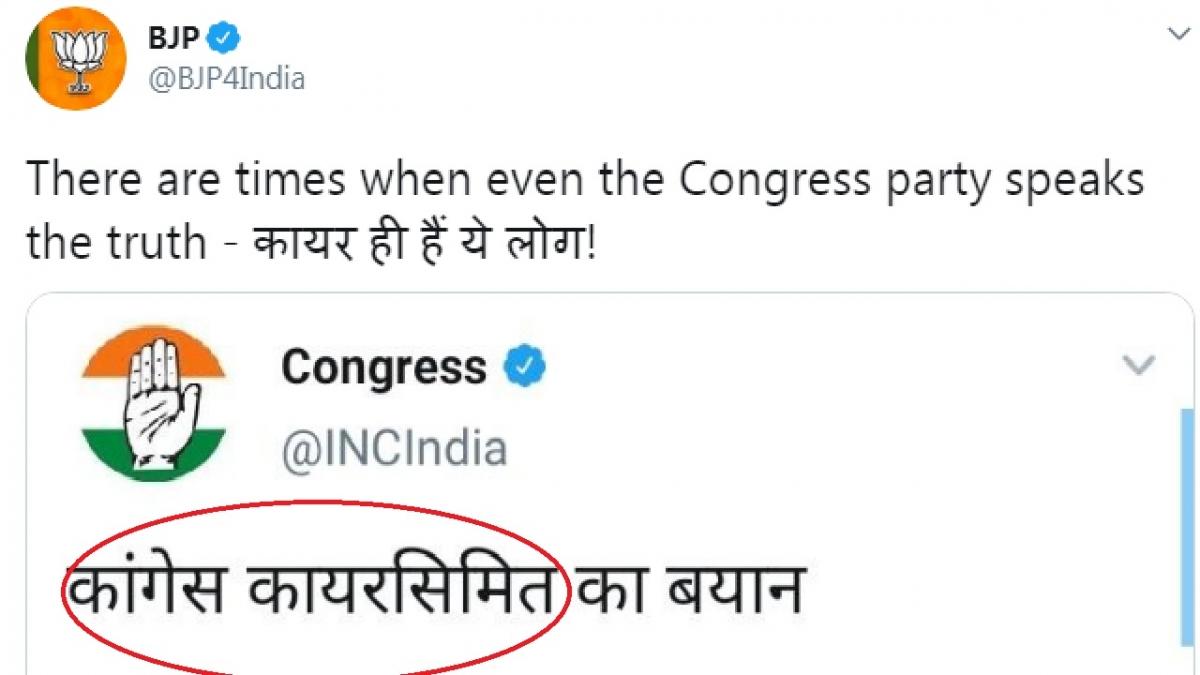

For example, when the authority declares that Bitcoin Cash and Litecoin can be purchased indefinitely, while Cardano or Polkadot coin can be purchased for a maximum of CAD 30,000 per year, a dangerous suggestion of security is made. . Inexperienced investors may doubt that Bitcoin Cash is a particularly promising and secure project. Of course, everyone here may have a different opinion, but some crypto investors are likely to classify Bitcoin Cash as a failed hard fork. Instead of consumer protection, reverent signals are sent to investors. With their “whitelisting” the authorities are stuck in the crypto year 2017.

Canadian Consumer Protection: With Penny Stocks and Leverage Certificates in Bankruptcy

Given that Canadian retail investors can invest indefinitely in questionable penny stocks or leveraged derivatives where total losses are within reach, the new policy seems particularly absurd.

Every small investor has countless opportunities to stake their assets in minutes, but investing CAD 35,000 in Cardano (ADA), for example, is prohibited. Here the suspicion of double standards arises. The neutrality demanded from the state in this context has been dashed. One can only hope that this politically motivated wrong decision will be reversed soon.

Crypto speculation for pension funds is still allowed

It is even more reprehensible that the Canadian Pension Fund CDPQ 200 million CAD have to write, because it invested in Celsius. As an institutional investor, you are still allowed to speculate in the crypto lending sector. The requirements mentioned above only apply to retail and professional investors.

Do you want to buy cryptocurrency?

eToro offers investors, from beginners to experts, a comprehensive crypto trading experience on a powerful yet easy-to-use platform. We took a closer look at eToro.

Devoted web advocate. Bacon scholar. Internet lover. Passionate twitteraholic. Unable to type with boxing gloves on. Lifelong beer fanatic.